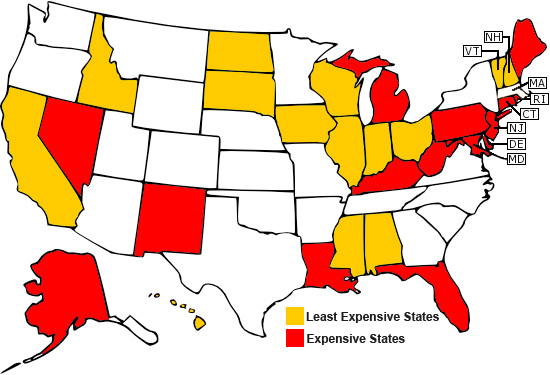

There are many factors that can influence car rates: mileage; vehicle age, make, and model; demographics (marital status, education and profession) and age etc. Each factor influences monthly and annual car insurance premiums. Geography, however, seems to be one of the top influential predictors of auto insurance premiums in the United States.

Most Expensive State Rates

Research shows the following top five states with expensive car insurance:

- New Jersey ($2,502)

- New York ($2, 307)

- Rhode Island ($2,298)

- Delaware ($2,225)

- Maryland ($2, 169)

These states are followed by:

- Louisiana ($2, 102)

- Connecticut ($2, 053)

- Michigan ($2, 032)

- Alaska ($1,925)

- West Virginia ($1, 863)

- Nevada ($1,845)

- Pennsylvania ($1, 754)

- Kentucky ($1,703)

- Florida ($1, 672)

- New Mexico ($1,663)

Least Expensive State Rates

The following five states are renown for inexpensive car insurance:

- Iowa ($1,040)

- Hawaii ($1,102)

- Maine ($1,156)

- Idaho ($1,175)

- Wisconsin ($1,189)

These states are followed by:

- South Dakota ($1, 218)

- Mississippi ($1,229)

- Alabama ($1,243)

- Ohio ($1,246)

- Vermont ($1,267)

- North Dakota ($1,280)

- Indiana ($1,303)

- California ($1,313)

- New Hampshire ($1,319)

- Illinois ($1,331)

Rural vs. Urban

One of the factors influencing car insurance rates is geographic location. New Jersey holds the highest car insurance rate in the country because New Jersey is an urban state. Urban states have sprawling populations, and massive population amounts increase the chances of accidents. Rural states, in contrast, have fewer residents. Hawaii is thus ranked second among inexpensive states because the state is more of a tourist attraction and a rural area than a residential city dwelling.

Pedestrian Fatality

One consequence of rural vs. urban life is pedestrian fatality (that is, how many accidental deaths occur each year). Washington D.C. has 3.2 deaths per 100,000 people, while Hawaii only has 1.9 deaths per 100,000 people. Florida has 2.9 deaths per 100,000 people, while Iowa has 0.6 deaths per 100,000 people. The more rural the state, the less likely accidental deaths will occur.

Auto Theft Rate

Not only are the chances of accidental death greater in urban areas, but also the auto theft rate (the likelihood of car theft). California has the highest auto theft rate, which explains why it is the sixth most expensive state in the country. The greater likelihood of auto theft, the heavier the financial cost to insure the vehicle.

Insured vs. Uninsured Drivers

If there are a greater number of uninsured drivers in a state, the insurance premiums of drivers will increase to compensate for the potential accidents expected from the uninsured. Mississippi and New Mexico rank first and second, respectively, in their numbers of uninsured drivers. This explains why New Mexico’s car insurance premium is approximately $1,663 a year. Mississippi’s car insurance is around $1,229 a year – still less expensive than New Mexico’s. However, Mississippi’s location near the Gulf of Mexico prevents the steep price tag that New Mexico residents face.

Weather

Along with geographic location, weather plays a significant role in auto insurance premiums. For example, Louisiana is located along the Gulf of Mexico, an area prone to the majority of hurricanes and tropical storms spawned in the Atlantic. For this reason, auto insurance premiums in Louisiana total $2,102. In contrast, Idaho is surrounded by Montana, Oregon, and Wyoming and is less prone to hurricane weather. Due to Idaho’s inland dwelling, auto insurance premiums in the state total $1,175 annually.

The geography of a state will determine to a large extent the kind of insurance premium a citizen of that state could find himself or herself paying: for geography affects auto theft rate, pedestrian fatality, accidental rate, weather, and so much more. While it could seem convenient to label geography the sole determinant of high/low insurance premiums, however, each state’s unique experience proves this to be extremely complex.